Budgets sound so boring don’t they?! The idea of budgeting sounds restrictive. It sounds anti-fun. It speaks “nerd”. But if you want to have any control over your spending, you need a budget.

Our Finances

When Mark and I married, I had about 3 years of my budget and bank statements in Microsoft Money. As a married couple, Mark handled the finances. He was more disciplined with the money and I’ll just be real here and say I love to shop.

Mark’s budgetting software of choice was a pen and a notebook. It nearly drove me insane to NOT have all our transactions logged. But I let go of it and let Mark deal with the money.

At the time, we had a pretty good income. Actually we were making REALLY good money and we were both working. Fast forward 11 years. Now we are on 1 income. Mark still makes good money, but until recently, we weren’t working towards our long-term financial goals (paying off camper and saving for life events).

As far as communication, our money conversations went something like this…

Julie: “Hey love, I want to go shopping for some clothes.”

Mark: “We don’t have money for that.”

or

Julie: “Hunka burnin’ love, I need to order some curriculum for next school year.”

Mark: “We don’t have money for that.”

or

Julie: “Babe, we need to get Pepper groomed.”

Mark: “We don’t have money for that.”

You get the picture I’m sure. In the end, we always ended up having money for “that”. But I was irritated that Mark was holding money back from me (and he was because he knew I’d spend it all if I could). As with many married couples, there was tension over money. I felt like I was always “asking” for money.

Now I say this with the utmost respect for Mark, but he is a penny-pincher. I know he makes good money but up until a couple months ago I had very little knowledge about where the money was going.

He was planning ahead (which is why we never had money for things I brought up) but give the guy a break, he doesn’t have a calculator for a brain. 🙂 Having to calculate and remember everything that is coming up can give a guy like Mark the feeling that they never have spare cash and they end up with added pressure.

Which brings me to the budget…

Mark’s paper and pen “system” works great as long as you write down every.single.transaction. If you don’t, you’ll never really see where you’re money is going.

I urged Mark to set up an electronic budgeting system and wanted to help with the budget (really, I wanted to go shopping – a little). I set out to find a program that would work well and that would be straightforward for my somewhat technologically challenged hubster.

Microsoft Money is gone now, and I never liked Quicken. Since we’re running on Macs I was at a loss for what to use. Great friends of ours recommended YNAB (You Need A Budget). I got the free 34-day trial and hit the floor running with it.

YNAB

Woah! I got more than I bargained for!

YNAB’s approach to money management exceeded my expectations.

Let me tell you, this software is NOT Quicken and it’s NOT Microsoft Money. It’s better. I can wholeheartily say I LOVE it. YNAB has even converted Mark who hates programs.

From the transaction tracking standpoint, it is just as good as Quicken or Money. But as far as planning and budgeting, it is FAR FAR superior because it’s designed to teach you to live within your means and plan for future expenses.

YNAB has an approach to money that is simple and no-fuss:

YNAB Has 4 Basic Money Rules

- Give Every Dollar a Job

- Save for a Rainy Day

- Roll With the Punches

- Live on Last Month’s Income

YNAB’s site is full of tutorials and how to’s. Customer support is quick and helpful. But from a user standpoint, I’m going to give you a look see at our YNAB and how we use it.

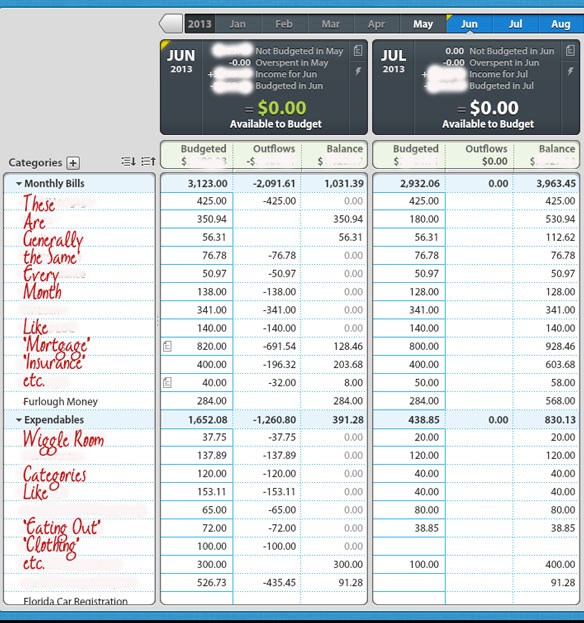

Our YNAB Budget

This isn’t the entire budget or our bank account info but it’ll give you an idea of how YNAB works for us.

You can see that we have every penny budgeted for both months. What we don’t spend this month, will roll into next month’s available. There is a chunk of money we are budgetting now to go for when Mark is forced into a furlough due to Congress’s budget problems.

We are planning ahead though.

See that Florida Car Registration? It’s pricy to register vehicles here so once the furlough is over, we’ll put some money towards car registration. But we look at our YNAB budget like a financial to-do list and reminder. It’s there and we won’t forget we need to set money aside for the registeration.

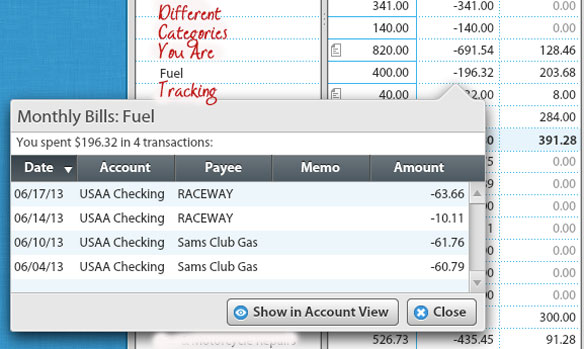

Above is an expanded view of the budget category and I just love it. When you click on a particular category’s “spent” column, a list of transactions that comprised that category’s spending pop up.

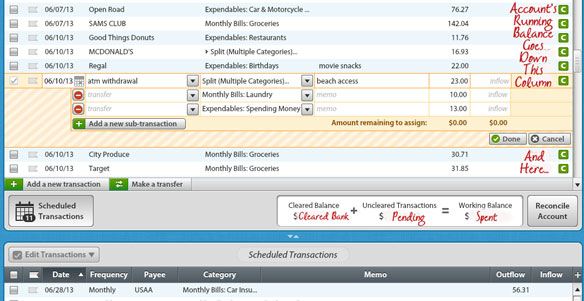

Here is a snapshot of the account view (this particular one is our checking account).

At the top portion of this view, is the checking account register.

One thing you’ll notice is the split transaction, “atm withdrawal”. When you click on that transaction, you can see what categories this withdrawal went towards. In this particular instance, we took some money out to pay for parking at the beach and the rest of it was for our laundry.

With YNAB, you have the option to split the transactions up so you keep your money in the correct category.

On the right side of the account view, you see a green “C” to signal a transaction has cleared your bank account, this is all tallied and you can see the total “cleared” or “uncleared”.

The last thing I want to point out about this view is the projected bills at the bottom of this account. You can schedule transactions to come out of your appropriate bank account in YNAB (just make sure you pay your bills in real life).

How It Has Worked for Us

After nearly a month of using YNAB, we have a way better picture of our money. We see that we were really blowing a lot of money on eating out and clothing.

YNAB has helped us plan for those bills that will be coming (like Zander’s hospital visit, the furlough, car registration, etc.)

FREE Android & iPhone App

YNAB also has a free app for Android and iPhone that is a great tool! When I’m out shopping and need to enter a purchase, I can do it quickly with the app. I can also check the budget to see if we have anymore clothing money available or bypass the thrift store.

Mark’s and my apps are sync’d with the main program on our computer and we’re BOTH aware of what is going on with our finances. That’s a huge benefit to us. I no longer have to ask him if I have money for new clothes, we’re on the same page financially and it’s been pure bliss.

In a nutshell, we whole-heartily recommend YNAB. Both of us.

It costs $54 for the Windows or Mac Version, if you buy through this link. If you buy from YNAB directly, it is $60.

*Disclaimer here: I get a small portion of money for referrals. My opinion of this product is completely my own and I would recommend this software regardless of whether there was a referral credit or not.*

You can download YNAB here and enjoy 34 day trial before you purchase.

If you use YNAB or converted to using YNAB, I’d love to hear your thoughts, good and bad on it. It’s really been what we needed without being overly complicated.

Wishing better budgetting to you!

As an Amazon Associate, I earn from qualifying purchases at no extra cost to you. Thank you for your support!

So glad I read your budget post tonight. There was a cyber monday deal for 50% off YNAB, and they also gave me the $6 off for clicking through from your link. So I got YNAB for $24!!! Thanks 🙂

I missed the sale Christy! But I’m so glad you got in on the deal!

Just downloaded the Free trial and am going to try it out! Trying to save so that eventually we can buy a truck to move our home! Also have some student loans that I would love to start paying early.

Hope you like it Kaelie! YNAB has been a great tool for our family!

I recognized a few years ago that I am simply horrible with bills and keeping track of my money. I did all of it before my husband died, but after that, it’s like I have a mental block against it. In 2011 I hired a Daily Money Manager. She has been a life saver. I am now finally debt free, have money in savings, and am buying an RV! I travel for work and am tired of packing and unpacking every three to six months and staying in hotels or iffy apartments when I’m working… I was going to buy a van camper, but the credit union had issues with that, so I am working on a used 23′ Cruise America rental (with extended warranties) that should be perfect for one person. I have been wanting to do this for eight years, but couldn’t until my DMM helped me get the debt paid off and my savings built up. But, what works for one will not work for another. I absolutely love your blog!

You are so right! What works for one, may not for another. Congratulations on meeting your financial goals! Best wishes to you as you find the right rig for your new home. My mom also travels and has taken up residence in a 5th wheel. (as long as she is not traveling in the northern states during the wintertime)